EUR/JPY Price Analysis: Bulls seek break of 21-D EMA

- EUR/JPY remains on course for a significant correction.

- The bulls are looking for a break of the 21-EMA on the daily charts.

As per the prior analysis, EUR/JPY Price Analysis: Bulls take charge, eye 61.8% Fibo target, the bulls remain in charge and on the move towards the said target area.

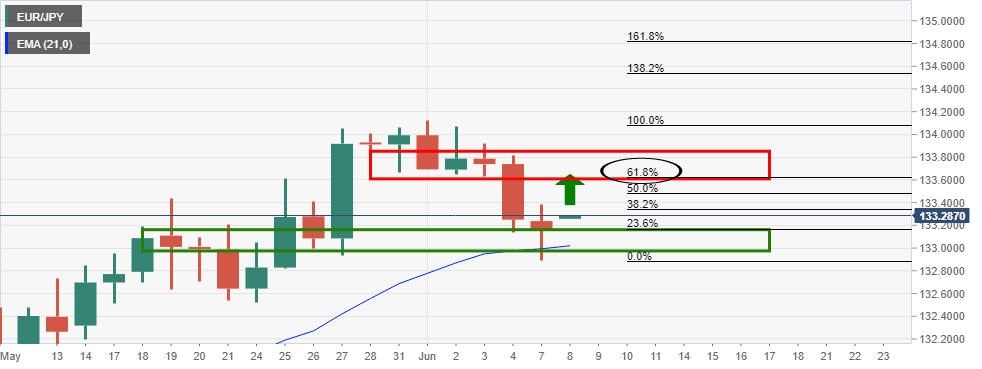

Prior analysis, daily chart

''The bulls can target the 61.8% Fibonacci retracement level and the M-formation's neckline.''

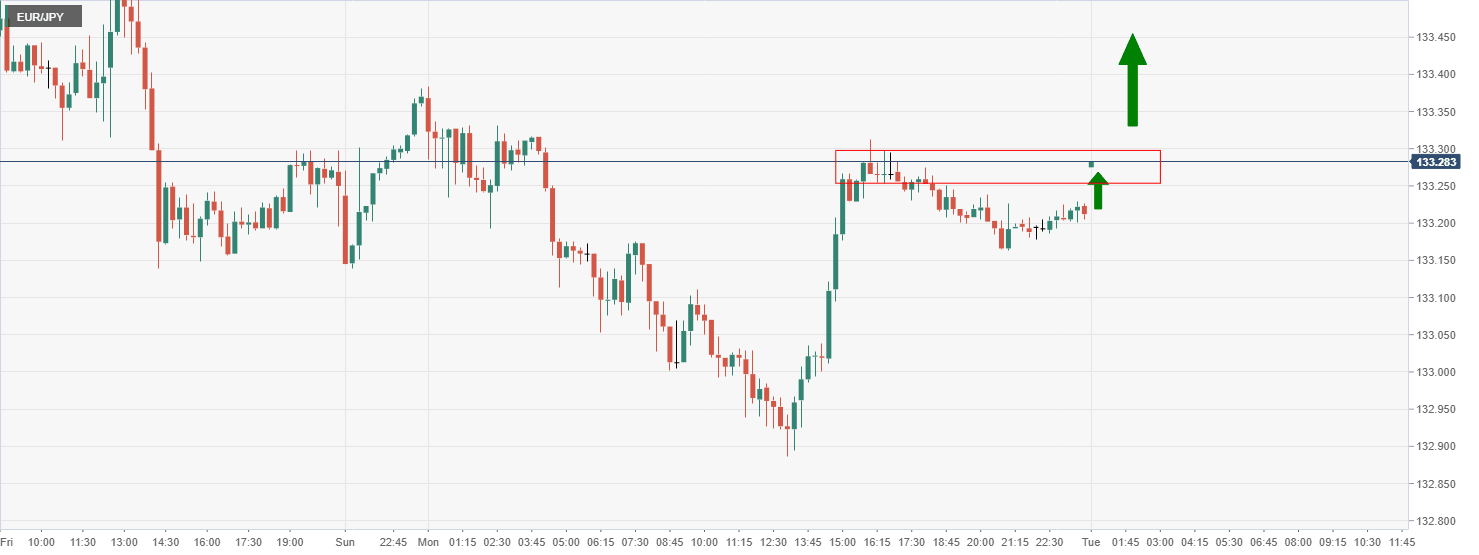

15-min chart, prior analysis

''From an hourly perspective, there is a strong bullish case given the prior bullish impulse, correction and now the current spike into the prior highs and presumed resistance.

A break of the resistance structure will align with the daily bullish M-formation's target keeping it firmly on the map.''

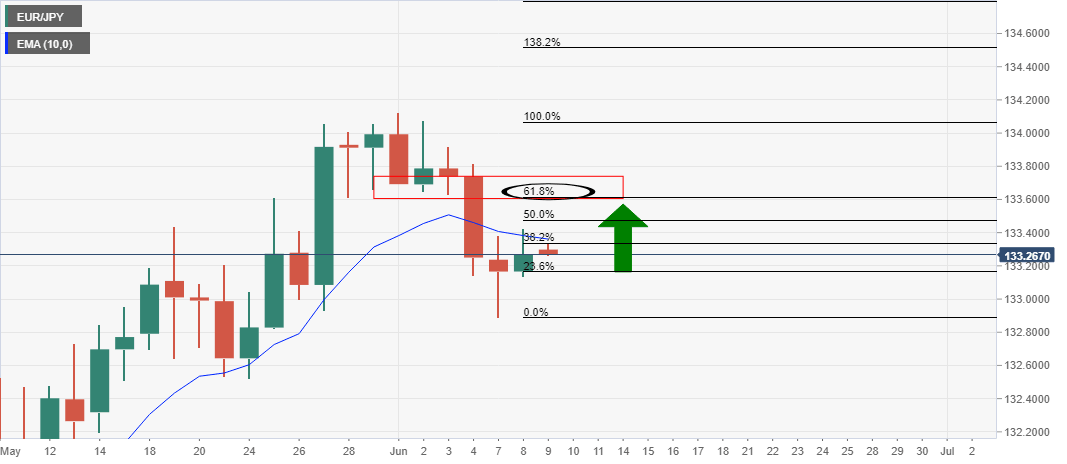

Live market update

The daily trajectory is still in shape and the bulls remain in control at this juncture.

A break of the 21-EMA on the same time frame will be highly bullish.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.